How do I submit a FERA application?

First, complete and sign the application. Next, submit your application using one of the following ways:

Error: Field cannot be left blank.

Error: Invalid entry. Do not use equal signs [=] or colons [:].

This summary is not available. For more details, open this PDF.

Error: Field cannot be left blank.

Error: Invalid entry. Do not use equal signs [=] or colons [:].

This summary is not available. For more details, open this PDF.

The Family Electric Rate Assistance (FERA) program helps eligible customers pay their energy bill. Income-qualified customers get an 18 percent monthly discount on electric rates.

Note: FERA and CARE share one application. If you do not qualify for FERA, we will check to see if you qualify for CARE. Learn more about CARE. In addition, other financial assistance resources and support are available.

In this section:

Your eligibility is based on your household income. To calculate your household income:

Note: Your household must be at or below the amounts shown in the income guidelines table below.

Household income includes all taxable and nontaxable revenues from all people living in the home. It includes, but is not limited to:

*Income should be before taxes and based on current income sources. Valid through May 31, 2026.

In this section:

If your household meets the eligibility requirements, the online form takes only a few minutes to fill out.

Download and print any of the following files:

Online applications in English, Spanish and Chinese:

Mail-in applications in English, Spanish, Chinese and Vietnamese:

Large-print, mail-in applications in English, Spanish, Chinese and Vietnamese:

First, complete and sign the application. Next, submit your application using one of the following ways:

PG&E CARE/FERA program

P.O. Box 29647

Oakland, CA 94604-9647

Fax: 1-877-302-7563

Email the completed application to CAREandFERA@pge.com.

Write "FERA application" in the email's subject line. Remember to attach your application to the email.

You must renew your enrollment every two years—or four years if you are on a fixed income. We'll remind you when it's time to re-enroll. Here's how it works:

Have you received a renewal request?

If you've received a renewal request, renew now. You may also renew if you're within 90 days of the date your current enrollment expires.

Access the form in Spanish: Programas FERA - Inscripción/Re-inscripción

Access the form in Chinese: FERA 計劃 - 申請或從新申請 - 第 1 步

To cancel your enrollment and/or opt out of future CARE/FERA communications, email CAREandFERA@pge.com.

Tenants of sub-metered residential facilities can apply for a monthly discount on their energy bill through FERA.

However, tenants of sub-metered residential facilities CANNOT use the CARE/FERA online application. To apply for FERA, you must download and print and application.

How do I download a FERA application for sub-metered tenants?

Download the CARE/FERA Sub-metered Residential Application (English) (PDF). Forms in languages other than English can be found in the "Forms and Guides" tab.

How do I submit a FERA application for sub-metered tenants?

First, complete and sign the application. Next, submit your application using one of the following ways:

PG&E CARE/FERA program

P.O. Box 29647

Oakland, CA 94604-9647

Fax: 1-877-302-7563

Email the completed application to CAREandFERA@pge.com.

Write "Sub-metered tenant application" in the email's subject line. Remember to attach your application to the email.

You must renew your enrollment every two years—or four years if you are on a fixed income. We'll remind you when it's time to re-enroll. Here's how it works:

Have you received a renewal request?

If you've received a renewal request, renew now. You may also renew if you're within 90 days of the date your current enrollment expires.

Tenants of sub-metered residential facilities CANNOT use the online CARE application. To apply for CARE, you must download and print an application:

To cancel your enrollment and/or opt out of future CARE communications, email CAREandFERA@pge.com.

Note: Check your PG&E bill to see if you're already enrolled in CARE/FERA or another program. Learn how to read your bill.

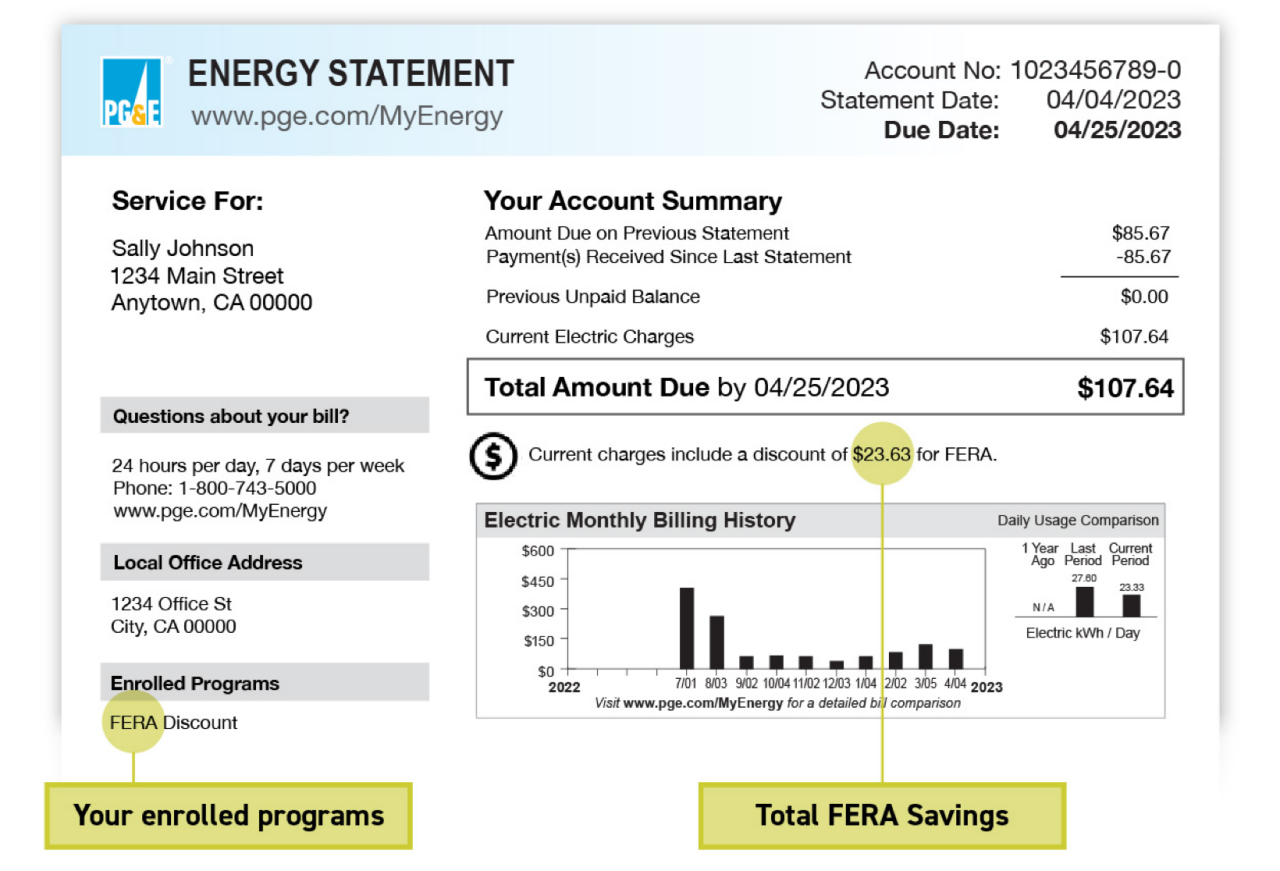

Find the programs you're enrolled in and your total FERA savings on your PG&E bill:

Note: We may ask for proof of your eligibility in the future. This is to maximize the discounts available through FERA.

After enrolling in FERA, you may receive a letter from PG&E that explains your household has been randomly selected to provide proof of income.

Note: If we do not hear from you by the date specified in the email or letter, your discount will be removed.

Scroll down to find the following PDF documents:

Most forms are available in:

FERA enrollment print applications

Still can't find an answer to your question? Email CAREandFERA@pge.com.

The FERA and CARE programs provide a monthly discount for income-qualified households. However, each program offers a different type of energy discount and has different eligibility guidelines:

FERA offers an 18 percent discount on electric rates. FERA does not offer a discount on gas rates. To qualify for the FERA discount, your household must:

CARE offers a minimum 20 percent discount on gas and electric rates. To qualify for the CARE discount, someone in your household must:

Note: FERA and CARE share one application. If you do not qualify for FERA, we will check to see if you qualify for CARE.

Proof of income is not required during the application process. However, we may randomly select you to provide income proof at a later date.

The discount will appear on the next bill you receive.

No. Each family must have a separate meter to receive the FERA discount.

Still unable to complete the process?

It's possible you're attempting to recertify:

If you're within 60 days of your enrollment expiration, and still can't recertify online, call 1-800-660-6789 to resolve the issue.

Find more information on how to renew FERA online.

Review the letter. Once you have identified and completed the missing information or documents, use one of the following ways to submit them:

Submit your documents online

There are two ways to submit your post-enrollment verification form online. Sign into your account:

Submit documents by mail or fax

Submit your documents by email

Do you still have questions? Email CAREandFERA@pge.com or call 1-866-743-5832.

Note: The income guidelines change each year in June.

No. You may only participate in one of the two programs at any given time. You can apply for FERA when your income meets the FERA income guidelines.

Call the FERA program at 1-877-660-6789 or send an email to CAREandFERA@pge.com.

Your eligibility is based on your household income. To calculate your household income:

Use only current and expected income for the next 12 months.

Are you receiving UI?

Are you receiving Unemployment Insurance (UI) benefits at the time of application? You can use your EDD award letter to calculate income based on how many weeks you are scheduled to receive payment.

Find information about discounts on phone and internet services.

Budget Billing is a free tool that averages your annual energy costs to help you manage your bills.

©2025 Pacific Gas and Electric Company

©2025 Pacific Gas and Electric Company